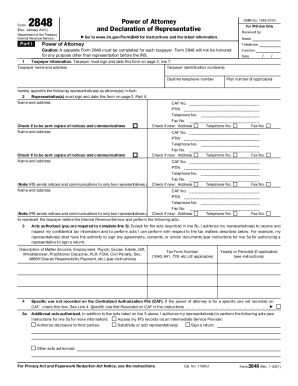

What is Form M-2848?

Form M-2848 is officially called the Power of Attorney and Declaration of Representative. The corporations must file this form. The Massachusetts General Law protects the taxpayers and their tax return’s information from disclosing. Thus, your corporation must complete this power of attorney to keep all tax records secure and safe.

What is Form M-2848 for?

Form M-2848 may be used for appointing the individuals for representing you in the matters of the tax before the Revenue Department. This form may also be used for all matters that affect the Commonwealth imposed taxes.

When is Form M-2848 Due?

There is no a specific deadline for the Power of Attorney and Declaration of Representative Form. However, do not delay completing and sending it.

Is Form M-2848 Accompanied by Other Forms?

If you have the earlier filed powers of attorney, attach the copies of them to the new one. If not, simply file our M-2848 separately without any other documents.

What Information do I Include in Form M-2848?

Generally, this document contains two parts. The first part is the power of attorney itself. In this part, you indicate the following:

- Name of taxpayer;

- Social security number;

- Address;

- Federal identification number;

- Type of tax;

- Period;

The second part is devoted to the declaration of representative. This section must be completed by all representatives. The applicants state that they are aware of all governing regulations. Signatures of all representatives are required.

Where do I Send the Power of Attorney and Declaration of Representative?

You must send this completed form to the Massachusetts Department of Revenue.